I recently mentored a young sales person regarding the nuances of the sales cycle. He relayed how much activity his firm generated by end of quarter. He exuded pride for the energy created from his sales managers’ added pressure and end of quarter discounts that bolstered sales. My friend was surprised to hear me say that, as a sales leader in my own company and my previous companies, I de-emphasize end of quarter sales pushes, and we rarely offer end of quarter discounts.

Are you surprised as well? After all, doesn’t the additional pressure and quarter-end discounting help meet a company’s sales goals?

Larry Fink, CEO of BlackRock, an asset management corporation that has over $4.5 trillion in assets under management, has a different take. He is on a campaign to encourage Fortune 500 CEOs to take a longer term view of creating shareholder value. See his letter here.

“We have done so in response to the acute pressure, growing with every quarter, for companies to meet short-term financial goals at the expense of building long-term value. This pressure originates from a number of sources—the proliferation of activist shareholders seeking immediate returns, the ever-increasing velocity of capital, a media landscape defined by the 24/7 news cycle and a shrinking attention span, and public policy that fails to encourage truly long-term investment.” –Larry Fink

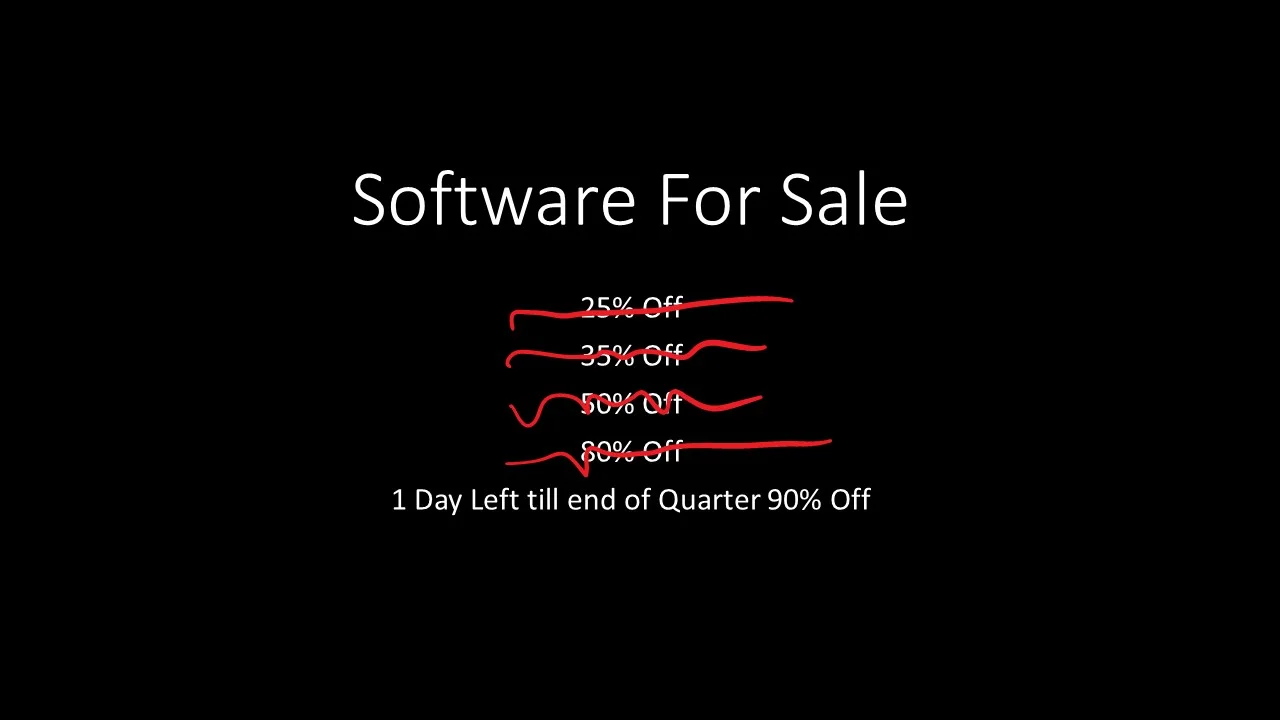

Fink’s mission runs counter to the way many companies have run their sales teams. My own experience leading enterprise software sales teams tells me that customers have become conditioned to expect huge vendor discounts at end of quarter, and it isn’t simply the smaller companies that fall into this trap. In fact, companies like Oracle are known for discounts of more than 70%.

I don't believe that discounting at end of quarter maximizes customer value or shareholder value. Discounts rarely focus on customer value [AB2] and tend to focus on what is important to sales reps and sales management. A 70% discount on the wrong solution is by definition 30% too expensive.

Below are questions I train my sales teams to ask in order to focus on providing real customer value, along with typical responses:

Q. When is your end of quarter?

A. I can check, but I would rather focus on your timeline versus our timeline. Can we talk about your timeline?

Q. Can I get a discount?

A. We aren't opposed to helping you meet your financial objectives; but are you willing to help me with the justification write up for management?

Does our proposal exceed your total budget?

Are we more expensive or less expensive than your alternatives? By how much?

Can we review your return on investment calculations for this project?

If we offer a discount are you willing to do prospect site visits, industry interviews, public speaking or engage in other marketing activities post implementation?

Can we put your commitment in writing ?

What do you think? Will you help end the end of the quarter?